Building a high growth, income producing property portfolio…

Great, so you’ve decided to take action and secure your financial future by building a property portfolio.

You’ve already learnt how to generate a passive income of $83,200 pa by buying only 4 average-priced investment properties… but what now?

How do you actually get started?

More specifically, what sort of property should you buy and where?

Property investment, like any investment, is a numbers game in which your sole purpose is to achieve the best possible return on your money.

So, while property is often lauded for being a tangible investment, one you can ‘see, touch and feel’, remember it’s the numbers you need to fall in love with, not the property.

Decisions must be based on maths, not emotion – after all, the only reason to invest is to make profit!

How to ‘beat the market’ !

The ideal investment property is one with consistently high levels of capital growth and cash flow.

However, not all property is created equal – in fact, when comparing properties there’s often a significant difference in the amount of growth and income each produce.

So how do you find the top performing properties?

When it comes to residential property, the two major determining factors of capital growth and cash flow are – Location and Property Type.

- 1. Location = Capital Growth – the state, area, suburb and even street in which your property is located is by far the biggest factor in determining how fast your property will grow over time.

- 2. Property Type = Cash Flow – in addition to location, the size and style [ie. house, unit, apartment etc.] of the property you purchase will have a big impact on the rental returns you will achieve.

The good news is with the assistance of respected independent research and fundamental analysis it is possible to ‘beat the market’ and identify locations and properties likely to achieve better-than-average capital growth and cash flow!

1. Finding the right Location…

It’s simple, if you buy property in higher growth areas you will make more money!

In fact, just a small difference in capital growth can make a huge difference to your overall wealth down the track.

Using the Rule of 72 we can quickly estimate the number of years it will take for a property to double in value based on a given annual rate of capital growth.

For example, if a property grows at an average rate of 4% per annum it will take approximately 18 years for it to double in value [72/4 = 18 years].

In contrast, if a property experiences 8% annual capital growth it will only take 9 years to double in value [72/8 = 9 years].

That’s quite a difference!

So how much capital growth can you expect to achieve when investing in property?

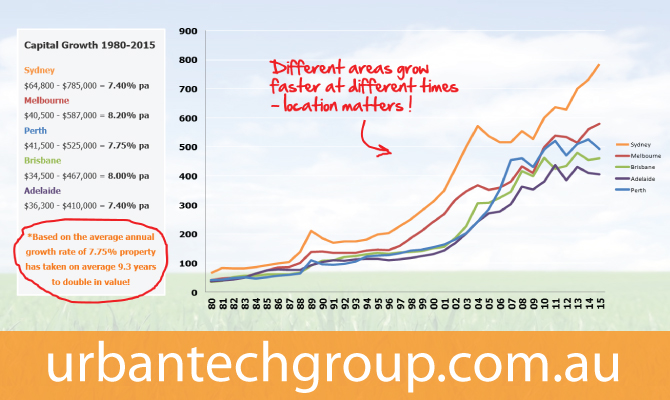

Here’s how the 5 biggest capital cities in Australia performed over a 35 year period;

Despite the obvious fluctuations, each capital city has achieved a compounding capital growth rate of over 7.4% per annum.

This means property prices, on average, have doubled every 10 years!

Analysing the Fundamentals

As an investor your goal is to buy property in areas with the potential to out-perform the general market.

By definition, the ‘average’ is average – meaning at any given time there’ll be a number of locations growing faster [and slower] than the average.

The faster growing areas contain a range of fundamental growth drivers which lead to the higher levels of capital growth.

In fact, these ‘hotspots’ commonly have three or more of the following elements in play;

- Transport Infrastructure – new or upgraded roads, highways, rail links or bridges

- Education-Medical Infrastructure – schools, universities, medical centres and major hospitals

- Ugly Ducklings/Cheapies with Prospects – the renovation and beautification of inexpensive properties in good areas

- Urban Renewal and Government Policy – urban gentrification projects vs growth management policys

- The Stayers – areas proven to provide solid capital growth in good and bad times

- Ripple Effect – the flow on of capital growth into a less expensive, and previously less desirable, neighbouring suburb

- Lifestyle Features – restaurants, cafes, shopping strips, and ocean or river views

- Boom Town Syndrome – mining booms and other major industrial projects

- Sea Change and Hill Change – beachside suburbs or country areas close to major cities

- Jobs Nodes – major cities, shopping centres, industrial estates, airports and export ports

Individually each of these elements can drive up the demand for real estate and place upward pressure on prices and rents.

When combined, however, the resulting ‘hotspot’ can generate above average growth for many years!

Supply & Demand

Monitoring capital growth rates and changes in sales volumes [the number of properties that sell each month] is another effective way of identifying areas with the potential for better-than-average capital growth.

Sales volumes, in particular, can give you a good indication of the relative ‘supply & demand’ trends in various areas.

Generally speaking, an increase in sales volumes is evidence of a strengthening real estate market and is usually a good precursor to growing property prices.

Understanding Property Clocks and Cycles

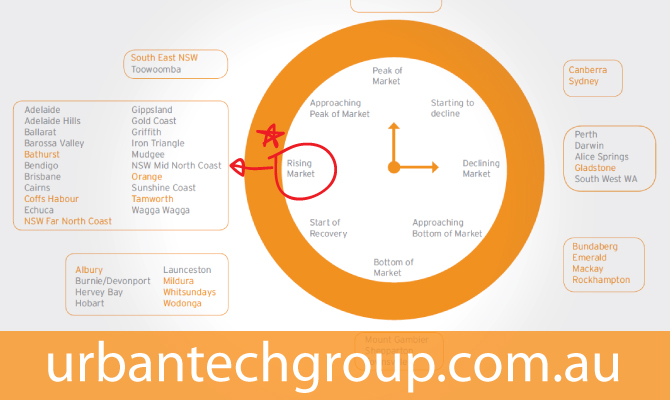

A property clock is a simple broad-brush tool to show the growth stage cycle of various areas, and in which direction prices are likely to move.

Here’s a look at a property clock published by property valuation and advisory group Herron Todd White;

Property clocks do a great job of focussing your attention on the best performing markets.

As a buy & hold investor your goal is to buy property in the locations listed at the ‘Rising Market’ segment of the property clock.

Based on research, these areas are predicted to give you the highest amount of capital growth over the medium and long term.

It’s important to note however, that markets don’t always move around a property clock through each stage – and there’s often large differences in the size of property price rises [and falls] between locations within the same segment.

For example, within the ‘rising market’ segment one location may go through a full ‘boom to bust’ cycle, while another location will experience steady price gains without any periods of negative growth.

Selecting Your Property Hotspot

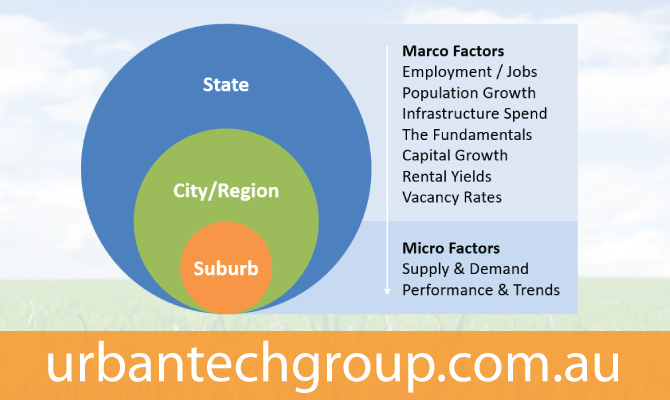

By bringing all of the research together it is possible to drill down and pinpoint the best locations [hotspots] to buy property in.

You are looking for the right mix of macro and micro factors in order for the area to produce consistent & high levels of capital growth, both now and into the future!

This is the process we use to identify the best suburbs to invest in;

Tip: By spreading your property portfolio over different states you can legally reduce [even avoid] the amount of Land Tax you pay. This is because land tax is only calculated on the accumulative value of land you own in each state. From an investment perspective it’s also smart to diversify your property portfolio over different regions and states.

2. Finding the right Property Type…

Once you’ve worked out ‘where’ you’re going to invest, you’ll need to get clear on ‘what’ you’re going to buy as well as you overall ‘strategy‘ in order to best achieve your goals.

As you know we’re strong advocates of the simple but powerful ‘buy & hold’ investment strategy.

We believe it to be the safest and surest way to generate an ongoing passive income from property.

It’s also ideally suited to inexperienced investors and those who are time-poor – which lets face it, is most of us these days!

Here’s a quick overview of why we prefer the ‘Buy & Hold’ strategy over Renovation or Development;

- Renovations – core strategy is to buy cheap, renovate and sell for a profit. It can be risky [ie. cost blow outs], time consuming, physically draining and you need a high level of expertise and experience to successfully pull it off time and time again. You also need to spend a lot of time trying to find the right property at the right price otherwise you’ll fail to make a profit. And if you sell the property within 1 year of purchase you won’t receive the capital gains tax [CGT] discount.

- Development/Subdivisions – core strategy is to build and sell new property for profit. Generally, it’s a lot more involved and complex than people think – it requires a lot of planning and expertise, involves large expenses and debts [ie. cash flow challenges] and the entire process can take years exposing you to ‘changing market’ risks. You’ll also be competing with lots of other experienced and well-resourced developers who are all vying for the same type of development sites.

- Investment – core strategy is simply to buy & hold property in order to generate a passive rental income. It’s a tried & tested strategy that anyone can understand and easily implement. As they say ‘slow and steady wins the race!’ Your only focus is to buy the right property in the right location. And because you’re investing for the medium to long term your margin for error is a lot larger – even if you pay too much for your property it will still double in value over time.

What type of property is best?

As a general rule we recommend buying Brand New residential property.

Compared to established property, new property offers a range of benefits including; stamp duty savings [ie. house & land packages], higher tax deductions/depreciation benefits, increased tenant appeal [higher rent and lower vacancies], and significantly lower maintenance costs.

Brand new property also makes for the perfect hands off ‘turn-key’ investment – so instead of concerning yourself with the hassles of the property repairs, improvements or even full-scale development you can simply focus your efforts on making sure all the numbers stack up on a deal.

And because it’s so hassle free, you can more readily and confidently purchase property anywhere within Australia – this gives you the scope to invest in the ‘best of the best’ performing areas around the country, rather than feeling constrained to your own local area.

Finally, we recommend investing in Houses [or Townhouses] rather than Units or Apartments. Research shows that on average houses achieve higher levels of capital growth and rental returns when compared with units and apartments.

Reasons include; houses cost less per sqm to build, they have a larger land component [buildings depreciate while land appreciates!] they are cheaper to hold and maintain [with no expensive strata fees to pay] and most tenants prefer them over apartments.

Tip: You can receive significant stamp duty savings if you buy brand new ‘house & land packages’ as opposed to buying property off-the-plan or after completion. With house & land packages you only pay stamp duty on the land component not the combined total purchase price. While you do incur some holding costs during the construction phase of the property, the overall savings are still substantial.

Dual Income Property

In recent times a new type of property has begun gaining in popularity, especially amongst smart investors, and it’s not hard to see why!

Dual Income Property is essentially a single property that’s made up of two separate homes, usually under the same roof, and on one single title.

As the name suggest these properties produce two separate incomes.

Here’s a few reasons why dual income properties make great investments;

- They’re cash flow positive from day one thanks to the two rental incomes

- You have lower rental vacancies as there’s two tenants and they pay a slightly reduced rental rate

- You can claim higher depreciation costs due to the doubling up of valuable items like kitchens, cabinetry, appliances, bathroom fixtures etc.

- The extra income improves your borrowing capacity which helps you to buy more property, sooner!

- If you’re an owner occupier you can live in one home and use the rent from the other to pay off your home loan faster

Combined with the right location, these cash flow positive properties make the perfect investment – giving you both exceptional Income AND Capital Growth!

Tip: You can get an extra boost in capital growth just by buying in the early stages of a new housing estate. Developers usually ‘stage release’ land to control its ‘supply & demand’ and to enable price increases with each new land release. This means by the time the estate is complete the land you purchased [and therefore your property] can be worth considerably more!

Dual Occupancy vs Duplex Property

Dual income properties come in all shapes, sizes and configurations, however they’re usually classified as either a ‘Dual Occupancy’ [Dual Occ] or ‘Duplex’ property.

Here’s a quick look at the difference;

- Dual Occupancy – two homes under the one roof and on one title. These properties often look like one large home from the front – the additional home is usually set back or located at the rear of the main home. Common configurations include a 3 or 4 bedroom home paired with a 2 bedroom home [3+2] [4+2], or a 3 bedroom home combined with a 1 bedroom home [3+1].

- Duplex – two homes on the one title but usually with a symmetrical façade that gives the appearance of two distinct homes connected by a common wall. These properties are generally larger and therefore more expensive than a Dual Occ. Common configurations include 4+4 and 3+3.

Here’s what a typical Dual Occ floorplan looks like;

Here’s what a typical Duplex floorplan looks like;

Duplexes – Instant equity through re-titling!

Unlike Dual Occupancy properties, some Duplexes can be ‘re-titled‘ – this means you can pay a fee to have an additional title issued so that each home has its own separate title.

The result is usually a sizeable increase in the value of the individual properties, not to mention the flexibility of being able to sell each home separately.

From a numbers perspective, you can usually buy a brand new Duplex on one title for around $100k less than the value of the two separately titled homes. So after re-titling costs of approximately $15k it’s possible you could end up with an instant equity gain of around $85k!

…which you could then use to buy your next property!

Where to from here…

You generally have three options to choose from;

- Procrastinate – Do nothing… Pay thousands more in interest and tax. Work your entire life only to end up on the pension [if there’s still one left!], needing to sell you family home just to survive;

- DIY – Do it yourself… Do you own research and hope you can buy the right property in the right area for the right price.

- Work with Professionals! – Take action… Work with us to build a personalised step–by-step plan to retire early & financially free!

DIY vs Working with Professionals

While buy & hold property investing is simple, it’s not always easy – there are still a lot of moving parts you need to get right in order to achieve the very best results.

Here’s a snapshot of just a few of the elements involved;

| Performing Property Research | Finding Suitable Property | Making an Offer |

| Real Estate Contracts & Law | Ownership & Structuring | Effective Tax Strategies |

| Arranging Finance | Building Insurance | Landlord Insurance |

| Property Settlement | Finding a Tenant | Collecting Rent |

| Property Inspections | Tribunal Hearings | Mortgage Management |

| Record Keeping | Tax Rulings | Personal Tax Variations |

| Regular Job | Time | Family |

…and there’s many more ‘what ifs’!

Life can be a cruel [and very expensive] teacher… even the smallest of mistakes now could end up costing you tens of thousands down the track.

Remember, it takes 9 years longer for a property growing at 4% to double in value compared to a property growing at 8% per annum.

That’s 9 years of capital growth you could miss out on just by buying in the wrong area!

Getting from A to B…

Property investment is all about getting a result, not owning a multi-million dollar property portfolio.

It’s about bridging the gap from where you are currently to where you want to be, as quickly and safely as possible.

For most, that’s done by creating an ongoing ‘passive’ income stream which allows you to live a better quality of life – one with more options and choices – and much less worry and stress!

Here’s how we can help you get from A to B…

THE REAL INVESTAR PROGRAM

The Real Investar Program will provide you with the knowledge, tools and support to build a ‘market-beating’ high growth property portfolio which provides you with the level of passive income you desire!

Simply put, we help you build a personalised property investment plan and then we help you implement it!

What we do is find the best locations and property in Australia for investors seeking Cash Flow and Capital Growth.

This includes Dual Occupancy property, Duplexes as well as off-the-market opportunities!

We do the hard work of finding the best quality builders at the lowest prices, as well as selecting the best properties and growth areas for you to consider.

All contracts are Fixed Price and every property is Turn-key and hassle free – this means they’re 100% complete [inside & out] and ready for tenants to move in.

There’s no hidden surprises or any extra money to be spent!

And unlike the property spruikers and investor groups we don’t sell our own property so you can be sure our advice is unbiased and independent!

As your property coach it’s our job to ensure you succeed! But as you can imagine time constraints mean there is a limit to the number of people we can work with. So if you’re interested you’ll need to lock in your place fast!

Oh and did you notice this amazing service is completely free! We only get paid if we get you a result and then it’s not even you that pays us.

>> For more details and to sign up for our free Real Inevstar Program – CLICK HERE

PS. A final word… A lot of people are afflicted by the two mortal enemies of wealth creation; umm & aah. They second-guess themselves; they find reasons not to act; they listen to barbeque chatter and scare themselves silly. They find incredible excuses not to buy a property. There is nothing wrong with being cautious; there’s nothing wrong with checking and rechecking. However, I see millions of dollars in future wealth left on the table by investors who get cold feet. Don’t let fear rule your wealth creation dreams, take action today!

If you need any other details or just want to chat further, please contact Sam on 0411 431 391

Cheers

Sam C

Real Investar

Property Investment Advisor

0411 431 391

sam@realinvestar.com.au