Wealth Creation 101

It’s the #1 irrefutable law of wealth creation and it goes like this; “Spend less than you make and [wisely] invest the difference!”

The only thing I would add to this classic pearl of wisdom is to re-invest some [or most] of your profits so you can tap into the miracle that is compound growth!

Sounds simple right, but how do you actually put this into action?…

Well, our ‘Golden Rule of Debt Reduction and Wealth Creation’ is a good place to start – it states the following;

Spend less than you earn, save the difference and use your savings to pay down or completely eliminate your non-deductible bad debt, whilst leveraging good debt to invest in income producing and appreciating assets.

We covered the first part of our golden rule in our previous article on debt reduction, so today we turn our focus to the final part of the equation – Investment.

No prizes for guessing that the income producing & appreciating asset we recommend you invest in is residential property.

But before you start looking at which investment property to buy it’s really important you get clear on your investing strategy and overall wealth goal.

Here’s how to do that…

Setting your Wealth Goal?

Consider the following list of potential weekly retirement incomes…

| Broke: | $400 net per week | |

| Just Getting By: | $500 net per week | |

| Moderately Secure: | $600 net per week | |

| Independent: | $1,000 net per week [*our min. goal is to get you here!] | |

| Financially Free: | $2,000 net per week | |

| Wealthy: | $4,000 net per week |

Now just answer these two simple questions;

- 1. How much passive income do you need per week to live comfortably in retirement? [eg. $1,000 pw after tax]

- 2. How many years from now do you want to achieve this passive income? [eg. 15 years]

Once you’ve set your wealth goal the next step is to plan out how you’re going to achieve it!

Here’s how you begin to do that…

The Net Asset Retirement Calculator

Assuming you can conservatively achieve a return of 5% pa, what level of net assets will you need in order to achieve your weekly desired net income at retirement;

| Desired Net Income | $1,000 | per week [today’s dollars, after tax] |

| x 52 | $52,000 | [A] per annum [net after tax income] |

| x 1.6 | $83,200 | [B] approximate before tax income [~37.5% tax rate] |

| x 20 [or ÷5%] | $1,664,000 | [C] Net Asset Required [based on 5% return] |

| ÷ by | 15 | [D] years to retirement |

| = | $110,993 | [E] Yearly Investment/Savings Required |

| ÷ 52 | $2,133 | [F] Weekly Investment/Savings Required |

Based on our example you would need to build a net asset base of $1,664,000 in order to achieve a desired net passive income of $1,000 per week [$83,200 pa before tax].

However, to accumulate this amount of money over 15 years you would need to save an incredible $110,933 each and every year!

The Challenge…

Most people cannot accumulate anywhere near the level of savings [including superannuation] they need in order to generate their desired passive income.

The Solution… build a Property Portfolio!

For example, with rental yields of 5% you can achieve the same net income of $1,000 pw [$83,200 pa] by building a $1,664,000 freehold property portfolio.

Which seems a lot more achievable doesn’t it!

Introducing the 10 yr Retirement Plan…

The 10 Year Retirement Plan

We created the 10 Year Retirement Plan to show you how simple it is to generate a reliable source of passive income through basic ‘no frills’ buy & hold property investment.

Our simple 4-Step Process shows you how to reverse engineer the exact property portfolio size you need in order to achieve your desired income.

THE 10 YEAR RETIREMENT PLAN

- 1. Set your Wealth Goal – decide how much passive income you want to achieve per week.

- 2. Determine the freehold property portfolio size you need using the Net Asset Retirement Calculator.

- 3. Keep buying investment property until you’ve reached ~110% of the freehold portfolio size you actually need.

- 4. Hold all properties until they double in value. Then sell half your portfolio, pay off all of the remaining properties, and live off the rents!

Now let’s see this in action…

CASE STUDY:

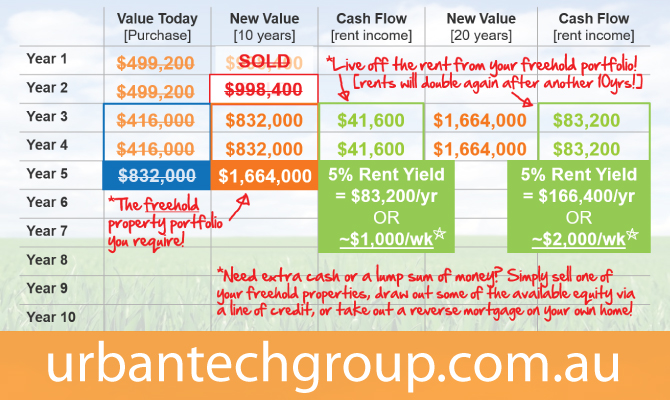

Based on our example above and working on an average rental yield of 5% pa you will need to build a freehold property portfolio worth $1,664,000 in order to achieve a net passive income of $1,000 per week [$83,200 pa before tax].

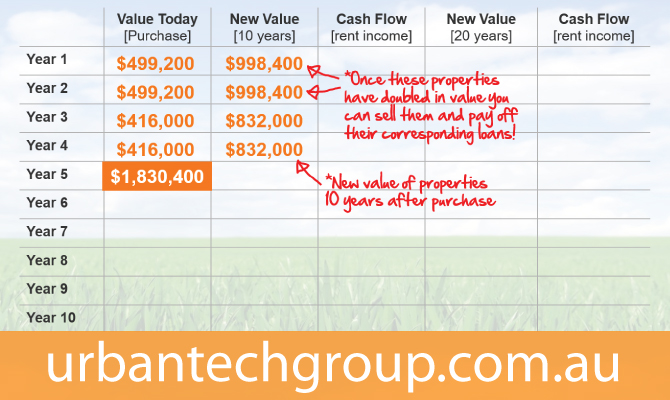

Here’s how you can do it by purchasing only 4 average-priced properties!

– Buy property until you have reached 110% of the freehold property portfolio size you require;

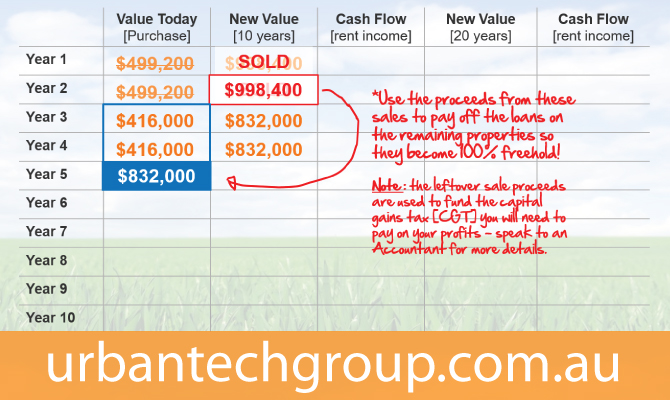

– Once the properties have doubled in value [~10 years later] sell half your portfolio;

– Use the proceeds to pay off the loans on your remaining properties so they become debt free;

– You’ve done it! You can now live off the rents generated from your freehold property portfolio;

Note: If you ever need extra cash or a lump sum of money you can sell one of your freehold properties, draw out some of the available equity via a line of credit, or simply take out a reverse mortgage on your own home.

Summary

There you have it, the exact strategy you can use to build a passive income of $83,200 pa [$1,000 pw net] with only 4 average-priced investment properties…

- … in as little as 10 years,

- … plus, your income keeps growing as rents rise each year – giving you Cash flow for life!

Did you catch that?…

You’ll have a passive income for life and because your income is in the form of rent it will keep increasing each year as you [or your property manager] adjust the rents up.

So eventually your rental income will double to $166,400 per year, and then more again – giving you, your family, and even future generations, a never ending supply of [increasing] income to enjoy!

Want to make $2,000 per week [net] or more?

Simply follow our 10 Year Retirement Plan 4-Step Process – it’ll tell you how big your freehold property portfolio needs to be in order to create the passive income you desire.

Then all you need to do is buy enough property, wait for it to double in value, sell half of it, pay off your remaining property and live off the rent!

A self-perpetuating wealth building system…

The 10 Year Retirement Plan is a self-perpetuating system that enables you to achieve long term wealth along with the lifestyle you desire – and all within a relatively short period of time.

Unlike other property investing strategies or systems our plan is simple, low risk, easy to implement and most importantly, it works!

What are the Risks?…

- No Tenant

- High Interest Rates

- Land Tax

- Changing Legislation

- Capital Gains Tax [CGT]

- Loss of Income

- High/Low Inflation

- GST

- Property Damage

- Market Decline

- Etc…

Risk Protection

The Right Insurances – You can take out a range of affordable insurances to mitigate most of the risks. These include: Landlords Insurance, Building Insurance, Income Protection, Life Insurance.

The Right Professional Advice – The other way to mitigate risk is to get quality professional advice! Your investment team should include the following people: Mortgage Broker, Financial Planner, Property Consultant, Home Builder, Accountant, Property Lawyer, Conveyancer, Quantity Surveyor and Property Manager.

What are the real risks?…

- Risk 1: YOUR current income is temporary! Most people spend their lives simply trading their time for money.

- Risk 2: YOUR income usually stops or reduces when you need it most!

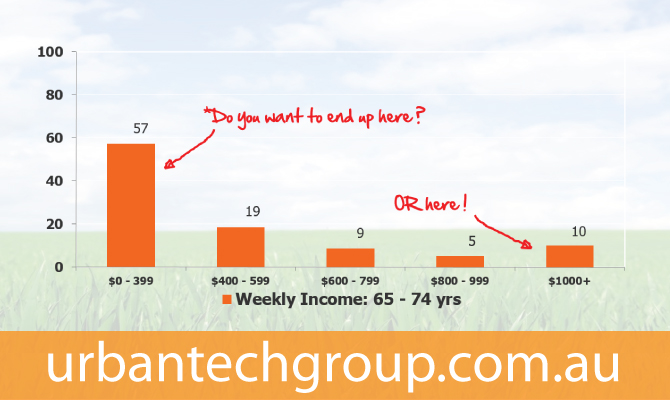

What is the risk of not taking action?…

After all, not making a decision is making a decision!

Remember only 10% of Australians will earn $1,000 per week or more in their retirement years!

Will you be one of them?

What’s the next step…

We can help you build a ‘market-beating’ high growth property portfolio which generates the level of passive income you desire.

>> For all details on our Real Investar Program click here

If you need any other details or just want to chat further, please contact Sam on 0411 431 391

Cheers

Sam C

Real Investar

Property Investment Advisor

0411 431 391

sam@realinvestar.com.au